by Joe Vaccarella | Jan 31, 2020 | Blog, Communications, Customer Service, Multi-channel, Omnigage, Thought Leadership

Joseph Vaccarella, Client Instant Access & Manish Patel, Tier1 Financial Solutions

Advancements in technology are helping sales, research and trading desks with more collaborative components to help them optimize their client relationships. Buy and sell-side firms have voiced that exchanging ideas and working together to achieve common goals around technology innovation is the optimal route. Fintech partners feel the same way and are increasingly collaborating on ideas and integrating their solutions to create a more efficient and streamlined workflow for all capital markets participants.

In this piece, we’ll be taking a look at why the marriage of customer relationship management (CRM) tools and multi-channel engagement technology is the perfect fit for today’s structural and regulatory landscape.

Fostering Better Communication by Embracing Collaboration

Managing a trading desk is already a loaded job, so streamlining your technology suite has to be a top priority to help ensure a productive workday. It’s imperative that managers dispose of the inefficiencies that can linger on sales and research desks such as weeding through spreadsheets, as these processes can consume an exorbitant amount of time in what is usually a hectic schedule.

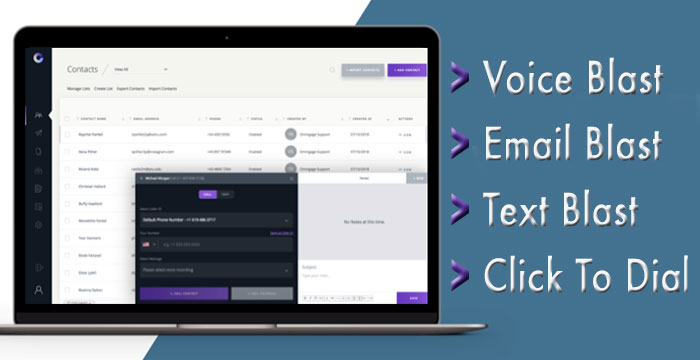

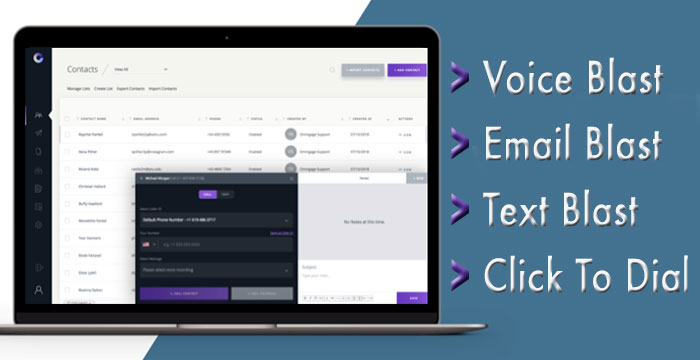

A robust CRM that’s supported by multi-channel communication tools streamline business processes and reinforces compliance protocols. This alliance of solutions allows you to communicate with your clients seamlessly via greater computer telephony integration (CTI) connectivity, whether by one-click-to dial, text, email or blast a voicemail. By taking the time to identify and develop relationships with premium technology partners, daily workflows are drastically improved which empowers company-wide innovation.

Unified communication is critical in today’s evolving marketplace. Getting there, however, can be challenging. While communication is often disparate and siloed across multiple platforms, a more productive approach leverages a unified platform that is purpose-built for financial services.

This allows users to quickly maximize calling, incoming call notifications, SMS, and email without having to exit their CRM. Capturing detailed activity history directly within your CRM across bulk and direct interactions not only saves time but also ensures accuracy over outdated manual entry processes.

Streamlined Efficiency through Automation

Although daily forecasts and weekly reports are two of the key value-add services that clients expect from research analysts, leaving messages for clients each morning is a cumbersome and time-consuming task. Pre-recorded messages covering multiple topics can alleviate this issue for both the end-user and the analyst. Messages can be blasted to clients overnight and available each morning as one of their top priorities.

Through a combination of CIA’s and Tier1’s offerings, market participants achieve a more seamless route to the pieces of research they want to hear about, using features such as Click-to-Dial. CIA’s Click-to-Dial saves users nearly 12 minutes for every 10 calls made and an hour for every 50 calls. By the end of a full work-week, this translates to almost an entire extra day of time saved that can be repurposed toward servicing clients and developing research.

In addition to saving time, there’s a compliance facet of working with vendors. CIA is SOC2-certified and has been engineered to meet critical regulatory guidelines, while Tier1 manages the increasing levels of relationship risk that exist between buy and sell-side counterparties in an increasingly regulated financial landscape.

With call lists more strategically organized and rapidly processed, users reach a wider audience through increased processing speed. As the number of calls per session increases, so will the likelihood of reaching clients for a one-on-one conversation. In instances where a live answer does not occur, a user can easily leave a pre-recorded message guaranteeing a rich, client touchpoint.

Interaction data gathered by the system can effectively be used to provide client engagement insights to enhance a communication strategy. For example, the CIA offering delivers a Best Call Time metric that will define the hours of the day a client is most likely to answer a call live. Such insights that are integrated with a CRM will allow a user to organize their day and ensure the most valuable outcomes from their engagement efforts.

Subsequently, having access to data on the best call time increases the chance of successfully delivering your message and fostering the relationship.

When encountering a situation where contacts do not want to be called, there’s the option of sending a message from your CRM. Sometimes a succinct text message is all a client may need. In addition, you have the option to still send a standard email with the latest research report as an attachment, helping to ensure a more personal relationship with the client while letting them know that you have their interests in mind.

In either case, users benefit from built-in efficiency, robust CTI connectivity and a compliant technology suite, allowing them to focus on their message instead of the laborious data-input process.

Leveraging the Next Generation Cloud CTI

Collaboration between technology providers and end-users drives greater efficiency, scalability and flexibility. For professionals across capital markets, collaboration helps convert bulk outbound activities into high-value engagements and multi-channel inbound inquiries.

By using a communications resource that integrates CRM and telephony capabilities, users can initiate a high-value, one-on-one engagement through multiple channels. Whether through voice, SMS or email, this approach allows sales and research personnel to conveniently contact a client while having the interaction automatically recorded and create bulk engagements that reach large audiences with minimal time investment.

Maximizing the functionality of your relationship management tools and merging them with multi-channel engagement technology streamlines the pursuit of generating high-value relationships. Tier1’s open architecture, single pane of glass view provides end users with the flexibility they need, while CIA is the catalyst that makes visibility simple, allowing research analysts and salespeople to easily get in front of clients.

From trivial items such as converting a missed call into an SMS conversation to more onerous tasks such as organizing an entire client list, the marriage of CIA’s and Tier1’s premium services creates a glide path to greater customer engagement and optimal end-user performance.

For more insight, visit us at the Tier1 Capital Markets Lounge at Dreamforce 2019- www.tier1fin.com/dreamforce-2019.

ABOUT CLIENT INSTANT ACCESS, LLC

Client Instant Access, LLC was founded in 1997 and is headquartered in Parsippany, N.J. Our state-of-the-art dialing, messaging and conferencing services have made us a leader in the telecommunications industry, and we are the provider of choice on Wall Street and for financial institutions around the world. Co-founder and CEO Joe Vaccarella has over twenty years of conference calling and messaging experience, while the rest of the seasoned senior management team boasts over fifty years of diversified telecommunications experience. CIA employs approximately 100 professionals and maintains a 24-hour on-site conference calling and customer service support center to meet our clients’ needs. We offer the fastest, most productive and reliable systems available in the marketplace to a wide variety of industries. We also provide detailed reporting, feature-rich options, compliance tools and database management resources that rival other companies’ much more expensive Customer Relationship Management (CRM) systems. If your company wishes to integrate our services into an existing platform, we have developed a robust Application Programming Interface (API) that accomplishes this with ease. At CIA, we look forward to innovatively helping our clients meet and exceed their business goals.

ABOUT TIER1 FINANCIAL SOLUTIONS

Tier1 Financial Solutions is a leader in global relationship management software for the financial industry. It empowers its clients to increase productivity, reduce relationship risk and enhance customer ROI. Tier1 augments the Salesforce platform with a capital markets grade security engine, coverage management and accelerated web and mobile workflows to support the unique requirements of Capital Markets, Corporate & Investment Banking and Investment Management professionals. Trusted by more than 19,000 users worldwide, its flexible, scalable solutions empower collaboration, transparency and communication across the institutional financial ecosystem. In 2017, Tier1 Financial Solutions received significant equity capital to accelerate growth from a group of investors led by WaveCrest Growth Partners with participation from MassMutual Ventures and Salesforce Ventures. For more information, visit www.tier1fin.com.

by Joe Vaccarella | Jan 30, 2020 | Blog, Communications, Financial, MiFID 2, Multi-channel, Omnigage, Thought Leadership

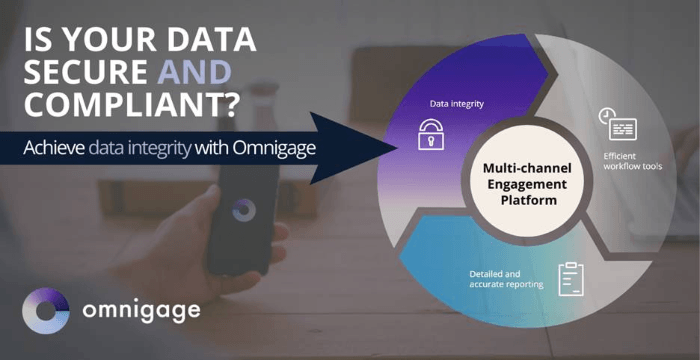

The financial industry is abounding with data, providing participants with ample opportunity to gain greater market insights and make more informed decisions. However, harnessing the oceans of data that’s available is a challenge faced by financial institutions, regulators and analysts. CIA’s Omnigage platform was designed to address this very issue.

In the first part of our series on how to enhance customer engagement practices, we examine the first of Omnigage’s three differentiators – data integrity.

Enhanced flexibility across your multi-channel engagement platform

When figuring out how to enhance technology capabilities for financial service firms, one of the first considerations must be the simplicity of the product. While flexibility and nimbleness are factors that firms desire when modernizing their fintech applications, they ultimately want something that can be easily implemented without disrupting their current workflow.

Omnigage is designed so that no additional plugins are required in order to access the platform’s suite of capabilities, whether it’s a banking analyst storing a list of contacts to issue research reports or a more advanced data set that’s applied across an organization.

With the ability to control data and content parameters across the platform and gain a holistic view of all customer information and data-driven insights, organizations are more efficiently able to identify opportunities and organize information without having to worry about data security or leakage.

Keeping up with compliance across customer communications

Compliance and regulatory initiatives – such as MiFID II, which was enacted on January 3, 2018 – have put a much greater emphasis on how data is managed and it remains a top priority for firms in 2020. With that in mind, the CIA team has a comprehensive understanding of these developments and has engineered Omnigage to ensure consistent compliance around global regulations. The platform not only allows users to review and submit data around engagements, but the process is seamless and effortless.

As the industry landscape becomes more complex and data demands more arduous, it’s important that firms do not underestimate the value of a solid client engagement platform so that the integrity of customer data is not compromised.

In Parts 2 and 3 of our series around elevating customer engagement practices, we’ll be looking at employing efficient workflow tools and the importance of detailed and accurate reporting.

by CIA Omnigage | Jul 15, 2019 | Blast Voice Mail, Blog, Communications, Conference Calling, Customer Service, Integrated CRM Dialer, Multi-channel, Omnigage, Success Stories, Thought Leadership

Top Benefits of an Auto Dialer in Call Centers

Having an autodialer has transformed the way call centers operate on a business scale. In the past auto-dialers have been known as just a way to dial out from a list of telephone numbers. However, in today’s world auto-dialers have been defined more as integrated software and can integrate into almost any CRM. For example, if a live person answers he/she would have a list of options to choose from. In addition, auto-dialers have the capability to detect answering machines, disconnected calls, etc. Auto-dialers can also be very beneficial for a variety of industries, such as for political campaigns and the banking industry. An auto dialer can help in the process of conducting polls for the political sector and also handling large amounts of a customer database for large banks. It is important to note that auto-dialers can have many benefits for small businesses and on an enterprise scale.

How can an Auto Dialer Improve Call Centers?

Generate More Leads

Businesses can utilize an autodialer as a way to boost sales leads. An agent can gather information about the contact prior to a call and have a more personalized conversation, which can help increase engagement and the chances of lead conversion. An auto dialer will also help maximize the number of call connections and give agents a better chance to close a lead.

Real-Time Reporting

An auto dialer software has the ability to provide custom reports, which helps agents understand any real-time statistics and whether there were any issues. This user-friendly interface can give you metrics based on real-time reports. Auto-Dialers also give you access to call recordings, which can be beneficial to managers when overseeing agents’ performance.

Increased Agent Talk Time

In the past, many call centers have used manual dialing as a way to call out to different prospects. However, auto-dialers have been used more frequently as a way to increase productivity and efficiency for call agents. This allows increased talk time between agents customers on the phone.

Custom messaging features

Call centers can benefit from an autodialer by also being able to leave a pre-recorded message that will automatically dial out to a list of contacts. In addition, you also have the ability to send a personalized message through text-to-speech or email if your voicemail got dropped. This process cuts down call time by a third and removes the time of waiting for someone to answer the phone.

Overall, auto-dialers have been used as a way to call centers to improve the process for outbound dialing. Connecting with customers at a fast pace is essential in our world today. With an autodialer, you can make sure call agents have the best tool to reach out to their customer base.

For more information on how an autodialer can improve your call center, visit www.callcia.com or reach us at sales@callcia.com.

by CIA Omnigage | Nov 15, 2018 | Blog, Integrated CRM Dialer, Omnigage, Success Stories, Thought Leadership

In the current digital climate, workers have copious options when deciding how to communicate with clients. Phone, SMS, email, and voice blasts are all ways to reach your clientele, but this wide variety can cause disorganization and hurt communicative efficiency.

Enter the new Omnigage Platform that allows users to integrate their communication needs into a CRM like Salesforce as an embedded terminal. This application is a one-stop-shop for anyone seeking a greater level of coordination within their professional life. Users can manage multiple contact lists and engage with them under customizable rules for formula-based customer interactions. This optimizes the range of your business and is an invaluable tool communications tool.

The embedded dialer allows users to send voice messages, calls and texts individually or to entire contact lists. This sort of power is crucial to businesses seeking to establish a more comprehensive relationship with customers. Metrics are provided to offer key insight into what drives your customers, which helps a company cater to customers more precisely and profitably.

This Omnigage Platform is compliant with Salesforce and other CRMs. Users can integrate this convenient application. Thus duality is representative of the many ways in which this program can help businesses establish close relationships with their clients.

This program also has features that are standard under the Client Instant Access umbrella-like transcriptions for calls, detailed engagement reports, and customizable contact creation. These features are designed for easy use and maximum efficiency when talking with clients. The Omnigage Platform is an essential part of any business getting in touch with clients.

by CIA Omnigage | Aug 22, 2018 | Blog, Integrated CRM Dialer

CIA Omnigage provides a one-stop-shop for all customer communication and CRM needs with their Integrated CRM Dialer.

CRM’s are a huge part of any company’s day-to-day operations. However, the process of using one can become complex and inefficient. Customers will use a calling service, and then record customer relations in a different CRM.

CIA Omnigage, however, diverges from the herd in this respect. We provide a one-stop-shop for all customer communication and CRM needs. With different features like our CIA portal for logging call information, we provide our customers with efficiency and convenience.

Using CIA as a CRM can be achieved in a few ways. One way is through our note-taking feature on the Integrated CRM Dialer. When making hundreds of calls, a client does not need to leave the page she is making calls from. She simply clicks on the contact and takes notes about the call. If the client did not answer, she can simply mark it as unanswered.

This note-taking feature of our Integrated CRM Dialer allows our customers to stay organized and keep track of their customer relationships under one platform.

To farther enhance the experience of a CRM with CIA, our Integrated CRM Dialer also saves all contact information in the CIA portal. This ensures that an analyst will not lose track of new customers. The Integrated CRM Dialer also helps improve customer relationships by allowing the analyst to easily put these contacts into groups.

These contacts will be key to an analyst and require no extra work of her. All the information stays on the same platform, and the entire process remains simple and uniform.

Finally, CIA also offers a call record log with their Integrated CRM Dialer. This allows our clients to see all calls they have made and judge their success rates. It’s a vital piece of what makes CIA Omnigage’s Integrated CRM Dialer product an effective CRM.

CIA Omnigage’s products offer to click to dial services as well as an Integrated CRM features that make the company the top choice for Wall Street banks. Our reliability and compliance have shined on Wall Street for nearly two decades. Let us show you how an Integrated CRM Dialer can improve your results.